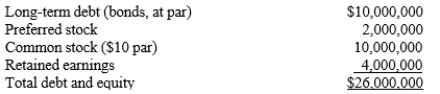

In order to accurately assess the capital structure of a firm, it is necessary to convert its balance sheet figures to a market value basis. KJM Corporation's balance sheet as of today is as follows:  The bonds have a 4.0% coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 10 years from today. The yield to maturity is 12%, so the bonds now sell below par. What is the current market value of the firm's debt?

The bonds have a 4.0% coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 10 years from today. The yield to maturity is 12%, so the bonds now sell below par. What is the current market value of the firm's debt?

A) $5,276,731

B) $5,412,032

C) $5,547,332

D) $7,706,000

Correct Answer:

Verified

Q82: Sadik Inc.'s bonds currently sell for $1,280

Q94: If 10-year T-bonds have a yield of

Q98: Wachowicz Corporation issued 15-year,noncallable,7.5% annual coupon bonds

Q109: Taussig Corp.'s bonds currently sell for $1,150.

Q109: Cosmic Communications Inc. is planning two new

Q112: Keys Corporation's 5-year bonds yield 7.00%, and

Q113: Keenan Industries has a bond outstanding with

Q114: O'Brien Ltd.'s outstanding bonds have a $1,000

Q115: Moerdyk Corporation's bonds have a 10-year maturity,

Q118: Crockett Corporation's 5-year bonds yield 6.85%,and 5-year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents