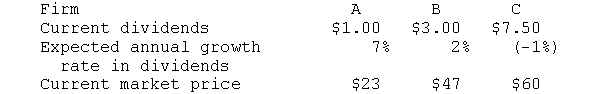

As an investor you have a required rate of return of 14 percent for investments in risky stocks. You have analyzed three risky firms and must decide which (if any) to purchase. Your information is

a. What is your valuation of each stock using the dividend-growth model? Which (if any) should you buy?

b. If you bought Stock A, what is your implied rate of return?

c. If your required rate of return were 10 percent, what should be the price necessary to induce you to buy Stock A?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: The required return includes the risk-free rate

Q5: According to the efficient market hypothesis, purchasing

Q18: According to the efficient market hypothesis, purchasing

Q21: If the ratio of price to book

Q24: Use of P/E ratios will not produce

Q28: You know the following concerning a common

Q30: If you purchase TrisCorp stock at $71

Q31: The risk-free rate of return is 8

Q32: Your broker recommends that you purchase XYZ

Q34: The use of price to book ratios

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents