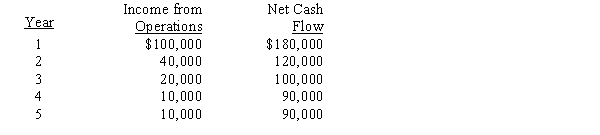

The management of Zesty Corporation is considering the purchase of a new machine costing $400,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for Years 1 through 5 are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability of this situation:  The cash payback period for this investment is

The cash payback period for this investment is

A) 5 years

B) 4 years

C) 2 years

D) 3 years

Correct Answer:

Verified

Q92: A series of equal cash flows at

Q93: Heidi Company is considering the acquisition of

Q94: The production department is proposing the purchase

Q95: The management of Wyoming Corporation is considering

Q96: When several alternative investment proposals of the

Q98: The management of Wyoming Corporation is considering

Q99: Which of the following is not an

Q100: The production department is proposing the

Q101: Which of the following can be used

Q102: Use these present value tables to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents