Schultz Tax Services, a tax preparation business, had the following transactions during the month of June:

1. Received cash for providing accounting services, $3,000.

2. Billed customers on account for providing services, $7,000.

3. Paid advertising expense, $800.

4. Received cash from customers on account, $3,800.

5. Owner made a withdrawal, $1,500.

6. Received telephone bill, $220.

7. Paid telephone bill, $220.

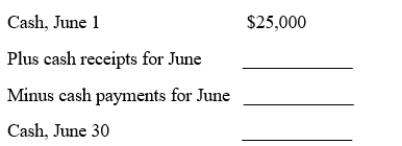

Based on the information given above, calculate the balance of cash at June 30. Use the following reconciliation.

Correct Answer:

Verified

Q225: Using the following accounting equation elements

Q226: Indicate whether each of the following activities

Q227: The total assets and total liabilities

Q228: Using the following accounting equation elements

Q229: On March 1, the amount of

Q230: Selected transaction data of a business for

Q231: Given the following data:Dec. 31,Year 2 Dec.

Q232: The following data were taken from

Q233: Eric Wood, CPA, was organized on January

Q235: The accounting equation elements and their

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents