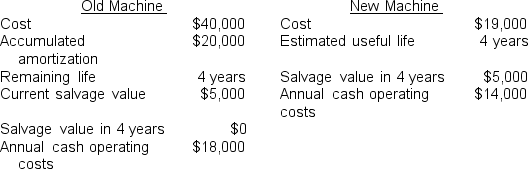

Bailey Corporation is considering modernizing its production by purchasing a new machine and selling an old machine. The following data have been collected on this investment:

The income tax rate is 40%, and the required rate of return is 16%. Amortization is $5,000 per year for the old machine. The new machine would be amortized $7,600 in 20x5, $5,700 in 20x6, $3,800 in 20x7, and $1,900 in 20x48. Assume Bailey would purchase the new machine in December 20x4 and dispose of the old machine in January 20x5.

The tax effect of selling the new machine in 20x8 would be:

A) $5,000

B) $3,000

C) $2,000

D) $0

Correct Answer:

Verified

Q50: Arnold Company is acquiring a new

Q51: Arnold Company is acquiring a new

Q52: The process that managers use when they

Q53: Bailey Corporation is considering modernizing its production

Q54: Valley Hospital is considering the purchase

Q56: The payback period is deficient as a

Q57: Which of the following is not a

Q58: Bailey Corporation is considering modernizing its production

Q59: Which of the following is the best

Q60: Arnold Company is acquiring a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents