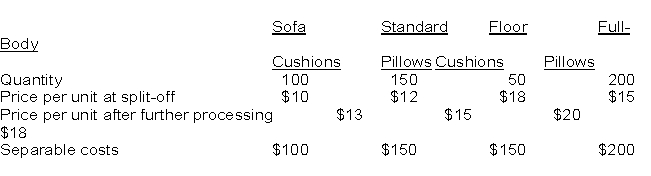

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below:  Joint costs for the accounting period totalled $5,000. Each product line has a different product manager who is evaluated based on product line profitability. Therefore each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

Joint costs for the accounting period totalled $5,000. Each product line has a different product manager who is evaluated based on product line profitability. Therefore each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

Which product line(s) would receive the least amount of joint cost under the sales value at the split-off point method?

A) Floor cushions

B) Full-body pillows

C) Sofa cushions and standard pillows

D) None of the above

Correct Answer:

Verified

Q73: HGT Corporation produces four products from a

Q74: When by-product value is recognized at the

Q75: HGT Corporation produces four products from a

Q76: Which of the following joint cost allocation

Q77: The joint cost allocation method affects the:

A)

Q79: Which method of allocating joint costs is

Q80: Managers should choose a joint cost allocation

Q81: J-M Company uses a joint process

Q82: Heston, Inc. produces 2 main products

Q83: Jagger, Inc. production begins in Department

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents