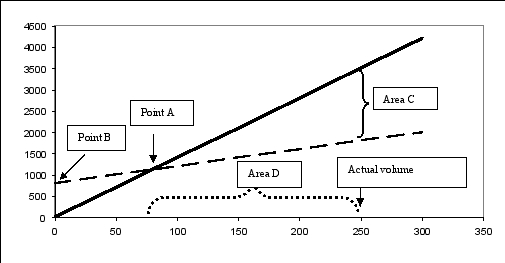

BETA sells its single product for $14 per unit, and its variable cost per unit is $4. Total fixed costs are $800. Its CVP graph is as follows:

If BETA increases its volume of sales by 10%, what will happen to its degree of operating leverage?

A) It will decrease

B) It will increase

C) It will stay the same

D) Cannot be determined

Correct Answer:

Verified

Q83: Smith Oil Co. expects sales of $1,000,000

Q84: If all other factors remain unchanged, a

Q85: Ferguson Co. incurs $568,000 in fixed

Q86: The Candle Company expects sales of $500,000

Q87: The breakeven point for a service organization

Q89: Dundas Inc. manufactures a single product. The

Q90: Ferguson Co. incurs $568,000 in fixed

Q91: The breakeven point for a service organization

Q92: BETA sells its single product for $14

Q93: Stuart, Inc. produces one item which sells

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents