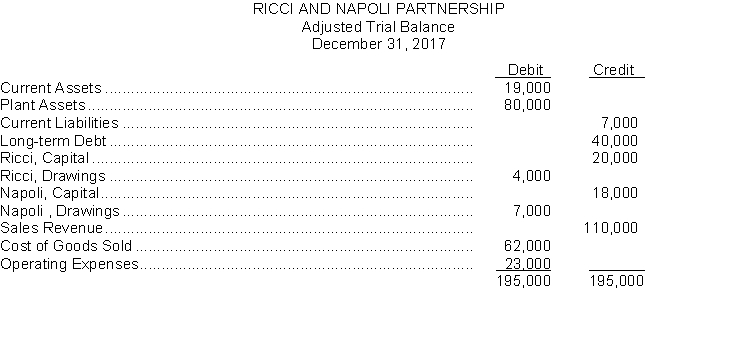

The adjusted trial balance of the Ricci and Napoli Partnership for the year ended December 31 2017 appears below:  The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows:

The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows:

1. A salary allowance of $12000 to Ricci and $23000 to Napoli.

2. The remainder is to be divided equally.

Instructions

(a) Prepare a schedule which shows the division of net income to each partner.

(b) Prepare the closing entries for the division of net income and for the drawings accounts at December 31 2017.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q166: Pellah (beginning capital $80000) and M. Berry

Q167: Juanita Gomez and Brandi Toomey have formed

Q168: In BigEasy Co. capital balances are Adrienne

Q169: The Jamison and Stephens partnership reports net

Q170: Barr & Eglin Co. reports net income

Q172: After liquidating noncash assets and paying creditors

Q173: Wiggins L. Stokes and K. Hayes are

Q174: Thao and Leslie are partners who share

Q175: Ando Dadd and Porter formed a partnership

Q176: Sonoma Company and Woodberry Company decide

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents