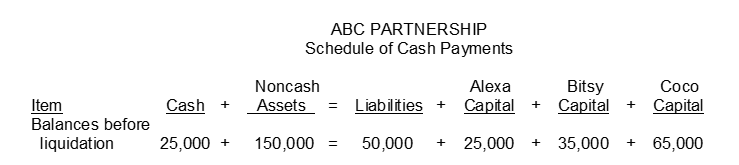

The ABC Partnership is to be liquidated and you have been hired to prepare a Schedule of Cash Payments for the partnership. Partners Alexa Bitsy and Coco share income and losses in the ratio of 4:3:3 respectively. Assume the following:

1. The noncash assets were sold for $70000.

2. Liabilities were paid in full.

3. The remaining cash was distributed to the partners. (If any partner has a capital deficiency assume that the partner is unable to make up the capital deficiency.)

Instructions

Using the above information complete the Schedule of Cash Payments below:

Correct Answer:

Verified

Q192: The Felton and Burchell Partnership has

Q193: Kim Locke and Mary Leigh Coker have

Q194: An income ratio based on _ balances

Q195: Brislin Humphreys and Watkins share income and

Q196: A major disadvantage of the partnership form

Q198: On December 31 Nola Company has cash

Q199: The HK Partnership is liquidated when

Q200: Prepare a partners' capital statement for

Q201: A debit balance in a partner's capital

Q202: In liquidating a partnership it is necessary

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents