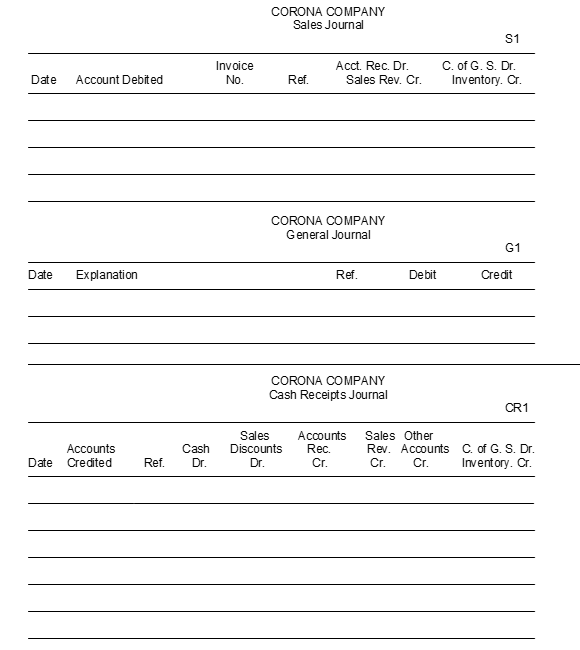

Corona Company uses a sales journal a cash receipts journal and a general journal to record transactions with its customers. Record the following transactions in the appropriate journals. The cost of all merchandise sold was 65% of the sales price.

July 2 Sold merchandise for $18000 to M. Jordan on account. Credit terms 1/10 n/30. Sales invoice No. 100.

July 5 Received a check for $1300 from K. Bryant in payment of his account.

July 8 Sold merchandise to S. O'Neal for $900 cash.

July 10 Received a check in payment of Sales invoice No. 100 from M. Jordan minus the 1% discount.

July 15 Sold merchandise for $7000 to K. Jabbar on account. Credit terms 1/10 n/30. Sales invoice No. 101.

July 18 Borrowed $15000 cash from Pacific Bank signing a 6-month 10% note.

July 20 Sold merchandise for $12000 to J. West on account. Credit terms 1/10 n/30. Sales invoice No. 102.

July 25 Issued a credit (reduction) of $760 to J. West as an allowance for damaged merchandise previously sold on account.

July 31 Received a check from K. Jabbar for $5500 as payment on account.

Correct Answer:

Verified

Q105: All of the following are advantages of

Q106: The Other Accounts column of a multi-column

Q107: Indicate in which journal each of the

Q108: If a customer takes a sales discount

Q109: Devotchka Co. uses special journals and a

Q111: In the expanded purchases journal debits are

Q112: Companies record credit purchases of equipment or

Q113: Which of the following is not an

Q114: Match each of the principles and phases

Q115: Bradshaw Company has a balance in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents