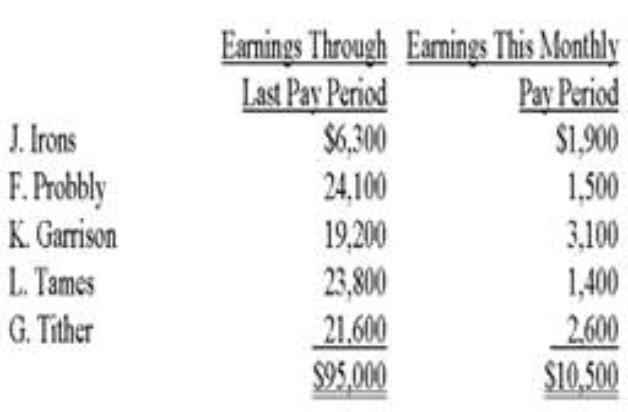

Dole Company employees had the following earnings records at the close of theNovember 30 payroll period:  Dole Company's payroll benefits expense for each employee includes: 4.95% CPP and1.88% EI on the amount earned. What is the total payroll benefits expense for theNovember 30 pay period?

Dole Company's payroll benefits expense for each employee includes: 4.95% CPP and1.88% EI on the amount earned. What is the total payroll benefits expense for theNovember 30 pay period?

A) $796.11 ($10,500 × (.0188 × 1.4) + ($10,500 × .0495) ) .

B) $1,039.50 ($10,500 × .0495 × 2) .

C) $519.75 ($10,500 × .0495) .

D) $276.36 ($10,500 × (.0188 × 1.4) ) .

E) $1,004.01 ($10,500 × ((.0495 + .0188) × 1.4) ) .

Correct Answer:

Verified

Q23: Payroll taxes and employee fringe benefits sometimes

Q24: Accrued wages are subject to payroll taxes

Q138: A tax levied on the amount of

Q141: Employers never make deductions from employees' wages

Q142: A record of an employee's hours worked,

Q144: M Company's 24 sales employees earned salaries

Q145: Most employers engaged in employing workers must

Q146: C Company has 7 employees who earned

Q147: A company's sales personnel earned salaries of

Q148: A company has 10 employees who earned

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents