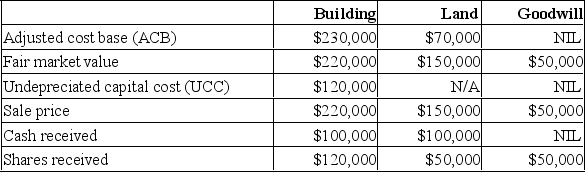

Janko Corp. has transferred the following three assets to Jumbo Corp., a Canadian controlled private corporation, under section 85 of the Income Tax Act.

Required:

Required:

Determine the following amounts:

A) The minimum amount that Janko may elect to transfer each asset in the rollover based on the information provided

B) Janko's income or loss for tax purposes as a result of the rollover

C) The ACB of the shares received by Janko following the rollover

D) The PUC of the shares received by Janko following the rollover

Correct Answer:

Verified

Q1: Which of the following statements is TRUE

Q4: Tony Brown sold 5000 of his shares

Q5: Corporation A is a Canadian controlled private

Q6: Which of the following scenarios would be

Q7: Ben is incorporating his proprietorship and transferring

Q8: Green Co.transferred a small piece of land

Q9: Anthony is the sole shareholder of Glass

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents