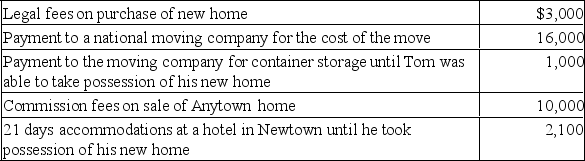

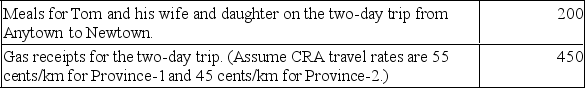

In 20x4, Tom Depuis moved 2874 kilometers from Anytown, Province-1 to Newtown, Province-2 to assume the position of manager for his company at the Newtown head office. Tom began his new job on October 1st. He receives a salary of $5,100 per month at his new job and received $4,500 per month in his former position. Tom has provided you with the following information pertaining to his moving costs:

Tom received a reimbursement of $15,000 from his employer.

Tom received a reimbursement of $15,000 from his employer.

Required:

A. Calculate the maximum amount of moving expenses that Tom can deduct on his 20x4 tax return.

B. Will the moving expenses have any effect on Tom's 20x5 tax return?

Correct Answer:

Verified

Q1: Which of the following deductions are allowed

Q2: Which of the following is FALSE regarding

Q4: Case One

Marsha had total income of $112,000

Q4: Which of the following examples of income

Q5: Steve gifted shares in a public corporation

Q7: Car Co.is selling its land and building

Q7: Identify whether the following sources of income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents