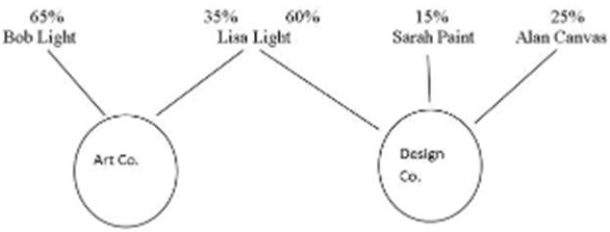

The following diagram depicts the ownership structure of two CCPCs. Bob Light is Lisa Light's son. Sarah Paint and Alan Canvas are not related to Bob and Lisa or to one another. All of the shares held are common shares.

In 20xx, Art Co. earned $700,000 of active business income and Design Co. earned $500,000 of active business income. Art Co.'s taxable income was $750,000 and Design Co.'s taxable income was $500,000. Art Co. reported $100,000 of adjusted aggregate investment income in the previous year. Design Co. did not report any investment income. The two companies have decided that Design Co. will not use any of the small business deduction in 20xx. The combined taxable capital of the two corporations is less than $10 million.

Required:

A) Determine if the two companies are associated, referring to the applicable section of the Income Tax Act.

B) Calculate the amount available for the small business deduction to Art Co. in 20xx.

Correct Answer:

Verified

Q1: Corporation X had a non-eligible RDTOH balance

Q3: Which of the following scenarios does not

Q4: Which of the following types of corporate

Q5: There are several benefits to incorporating a

Q6: Private Co. received a $5,000 eligible dividend

Q7: ABC Corporation ("ABC") is a Canadian-controlled private

Q8: Chartered Tours Inc. (CTI) reported a net

Q9: Bean Co. is a Canadian-controlled private corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents