Steven Co. is a public Canadian corporation which was established five years ago. The company's head office is located in Saskatchewan. In 2018, a small branch was established in Manitoba.

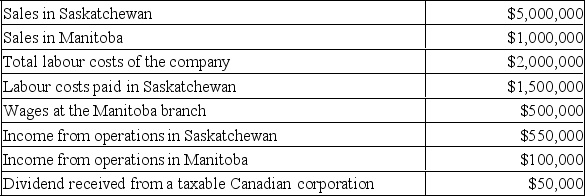

In 2019, the company's books included the following:

Required:

Required:

A) Calculate the company's net income for tax purposes for 2019.

B) Calculate the company's taxable income, both federal and provincial. (Round all amounts to two decimal places.)

C) Calculate Steven Co.'s Part I federal tax liability. (Round all numbers to zero decimal points.)

(Use tax rates and amounts applicable for 2019 for each of the above.)

Correct Answer:

Verified

Q2: The Canadian tax system practices integration between

Q4: Coffee Co. began operations in 20x0 and

Q5: When shares are transferred from one group

Q6: Which of the following scenarios is not

Q7: Johnson Co. is a CCPC with active

Q8: Bride and Groom Co. is a Canadian

Q9: Which of the following statements accurately describes

Q11: Using general terms, explain how a change

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents