Multiple Choice

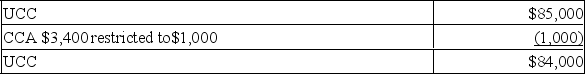

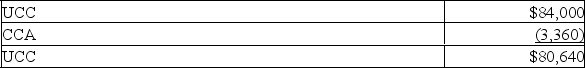

Jim Smith owns a rental property which had a UCC of $85,000 at the beginning of 20x0. After all allowable expenses other than CCA, Jim's total rental income was $1,000 in 20x0 and $10,000 in 20x1. Jim always deducts the maximum CCA allowed. What is the UCC for his rental property at the end of 20x1? (The property is a Class 1 building amortized at 4%.)

A) $78,336

B) $80,640

C) $84,000

D) $85,000

Correct Answer:

Verified

Related Questions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents