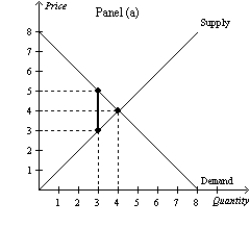

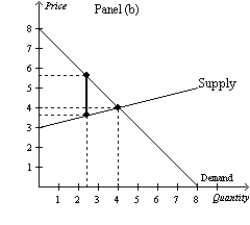

Figure 8-16

-Refer to Figure 8-16. Panel (a) and Panel (b) each illustrate a $2 tax placed on a market. In comparison to Panel (a) , Panel (b) illustrates which of the following statements?

A) When demand is relatively inelastic, the deadweight loss of a tax is smaller than when demand is relatively elastic.

B) When demand is relatively elastic, the deadweight loss of a tax is larger than when demand is relatively inelastic.

C) When supply is relatively inelastic, the deadweight loss of a tax is smaller than when supply is relatively elastic.

D) When supply is relatively elastic, the deadweight loss of a tax is larger than when supply is relatively inelastic.

Correct Answer:

Verified

Q2: A tax levied on the buyers of

Q6: When a tax is imposed on the

Q9: A tax on a good

A)raises the price

Q16: If a tax shifts the supply curve

Q28: One result of a tax,regardless of whether

Q45: As more people become self-employed,which allows them

Q57: Figure 8-15 Q127: What happens to the total surplus in Q130: When a good is taxed, Q198: Figure 8-17 ![]()

A)both buyers and![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents