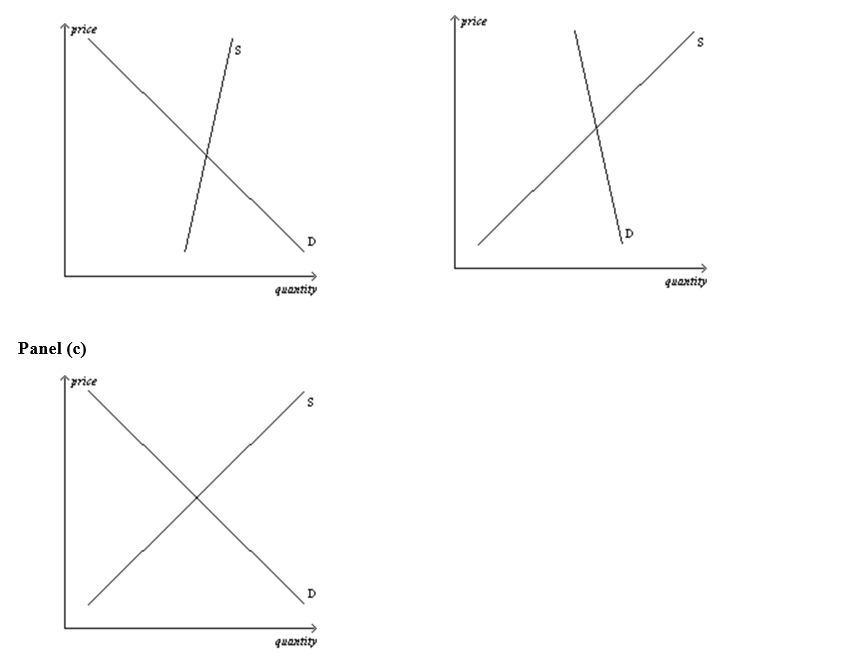

Figure 6-30

-Refer to Figure 6-30.In which market will the tax burden be most equally divided between buyers and sellers?

A) the market shown in panel (a) .

B) the market shown in panel (b) .

C) the market shown in panel (c) .

D) All of the above are correct.

Correct Answer:

Verified

Q189: Figure 6-29

Suppose the government imposes a $2

Q190: Figure 6-29

Suppose the government imposes a $2

Q191: In 1990,Congress passed a new luxury tax

Q192: Which of the following is correct? A

Q193: Which of the following statements is correct?

A)A

Q194: Suppose the demand for macaroni is inelastic,the

Q195: Which of the following was not a

Q197: The burden of a luxury tax falls

A)more

Q198: Figure 6-30 Q199: A tax burden falls more heavily on![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents