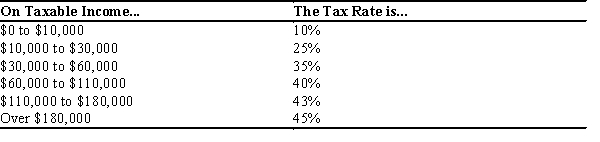

Table 12-6

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-6. For this tax schedule, what is the total income tax due for an individual with $49,000 in taxable income?

A) $12,650

B) $14,370

C) $15,960

D) $16,220

Correct Answer:

Verified

Q423: Table 12-4 Q424: Table 12-3 Q425: Table 12-3 Q426: Table 12-5 Q427: Table 12-3 Q429: Table 12-7 Q430: Table 12-4 Q431: Table 12-7 Q432: Table 12-6 Q433: Table 12-4 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()

![]()

The following table shows the marginal![]()

The following table shows the marginal

The table below shows the marginal![]()