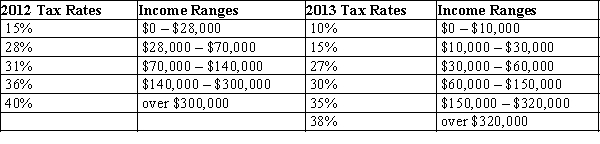

Table 12-9

United States Income Tax Rates for a Single Individual, 2012 and 2013.

-Refer to Table 12-9. Jake is a single person whose taxable income is $20,000 a year. What is his average tax rate in 2013?

A) 10%

B) 12.5%

C) 15%

D) 28%

Correct Answer:

Verified

Q438: Table 12-6

The table below shows the marginal

Q439: Table 12-7

The following table shows the marginal

Q440: Table 12-6

The table below shows the marginal

Q441: Table 12-9

United States Income Tax Rates for

Q442: Table 12-9

United States Income Tax Rates for

Q444: Table 12-9

United States Income Tax Rates for

Q445: Table 12-9

United States Income Tax Rates for

Q446: Table 12-7

The following table shows the marginal

Q447: Table 12-9

United States Income Tax Rates for

Q448: Table 12-10 ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents