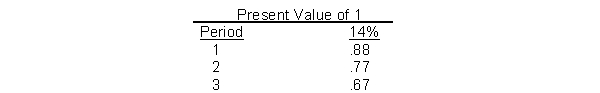

Woods Company wants to purchase an asset with a 3-year useful life, which is expected to produce cash inflows of $15,000 each year for two years, and $10,000 in year 3. Woods has a 14% cost of capital, and uses the following factors. What is the present value of these future cash flows?

A) $29,800

B) $30,400

C) $31,450

D) $34,750

Correct Answer:

Verified

Q102: Capital budgeting is the process

A) used in

Q104: A company is considering purchasing factory equipment

Q106: When using the payback method payback is

Q112: The higher the rate of return for

Q116: A company is considering eliminating a product

Q118: Aaron Co. is considering purchasing a new

Q119: Ruiz Company's contribution margin is $4 per

Q122: Fehr Company is considering two capital investment

Q123: Fehr Company is considering two capital investment

Q124: Use the following table, ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents