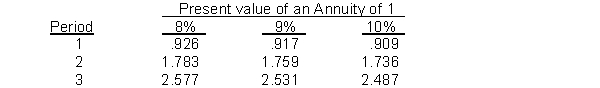

Use the following table,  A company has a minimum required rate of return of 8%. It is considering investing in a project that costs $227,790 and is expected to generate cash inflows of $90,000 each year for three years. The approximate internal rate of return on this project is

A company has a minimum required rate of return of 8%. It is considering investing in a project that costs $227,790 and is expected to generate cash inflows of $90,000 each year for three years. The approximate internal rate of return on this project is

A) 8%.

B) 9%.

C) 10%.

D) The IRR on this project cannot be approximated.

Correct Answer:

Verified

Q148: Use the following table, Q149: The appropriate table to use when an Q149: It costs Dryer Company $26 per unit Q150: Accounting's contribution to the decision-making process occurs Q151: Hale Plumbing used the net present value Q156: A cost that cannot be changed by Q156: The conceptually superior approach to capital budgeting Q157: In a make-or-buy decision opportunity costs are Q158: In using the internal rate of return Q159: Which of the following would generally not![]()

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents