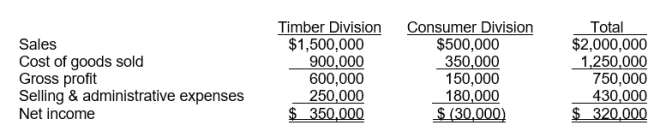

Trump Forest Corporation operates two divisions, the Timber Division and the Consumer Division. The Timber Division manufactures and sells logs to paper manufacturers. The Consumer Division operates retail lumber mills which sell a variety of products in the do-it-yourself homeowner market. The company is considering disposing of the Consumer Division since it has been consistently unprofitable for a number of years. The income statements for the two divisions for the year ended December 31, 2010 are presented below:

In the Consumer Division, 70% of the cost of goods sold are variable costs and 25% of selling and administrative expenses are variable costs. The management of the company feels it can save $45,000 of fixed cost of goods sold and $60,000 of fixed selling expenses if it discontinues operation of the Consumer Division.

Instructions

(a) Determine whether the company should discontinue operating the Consumer Division.

(b) If the company had discontinued the division for 2010, determine what net income would have been.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q189: Spencer Chemical Corporation produces an oil-based chemical

Q190: Ecker, Inc. produces milk at a total

Q191: Ridley Company has 8,000 machine hours available

Q192: Kasten, Inc. budgeted 10,000 widgets for production

Q193: Harris Timber Corporation uses a machine that

Q195: Speedy Bikes could sell its bicycles to

Q196: Finney Company estimates the following cash flows

Q197: Wesley Medical Center is considering purchasing an

Q198: Agler Corporation currently manufactures a subassembly for

Q199: Hughes Company manufactures and sells two products.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents