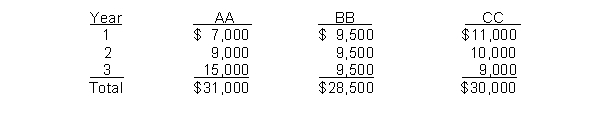

Cepeda Manufacturing Company is considering three new projects, each requiring an equipment investment of $20,000. Each project will last for 3 years and produce the following cash inflows.

The equipment's salvage value is zero. Cepeda uses straight-line depreciation. Cepeda will not accept any project with a payback period over 2 years. Cepeda's minimum required rate of return is 12%.

Instructions

(a) Compute each project's payback period, indicating the most desirable project and the least desirable project using this method. (Round to two decimals.)

(b) Compute the net present value of each project. Does your evaluation change? (Round to nearest dollar.)

Correct Answer:

Verified

$20,000 - ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q180: Notson, Inc. produces several models of clocks.

Q181: Milwaukee, Inc. has three divisions: Bud, Wise,

Q182: Coyle Company manufactured 6,000 units of a

Q183: Laramie Service Center just purchased an automobile

Q184: Mercer has three product lines in its

Q186: Larkin Company produces golf discs which it

Q187: Kinder Enterprises relies heavily on a copier

Q188: Kuhn Bicycle Company has been manufacturing its

Q189: Spencer Chemical Corporation produces an oil-based chemical

Q190: Ecker, Inc. produces milk at a total

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents