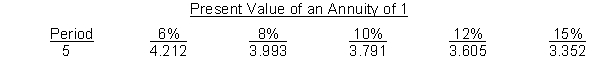

Yanik Company is considering investing in a project that will cost $162,000 and have no salvage value at the end of its 5-year life. It is estimated that the project will generate annual cash inflows of $45,000 each year. The company has a hurdle or cutoff rate of return of 8% and uses the following compound interest table:

Instructions

Using the internal rate of return method, determine if this project is acceptable by calculating an approximate interest yield for the project.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q197: Wesley Medical Center is considering purchasing an

Q198: Agler Corporation currently manufactures a subassembly for

Q199: Hughes Company manufactures and sells two products.

Q200: A recent accounting graduate from Marvel State

Q204: Gantner Company is considering a capital investment

Q204: The _ value of old equipment is

Q206: The internal rate of return method differs

Q208: The process of making capital expenditure decisions

Q209: The two discounted cash flow techniques used

Q214: A decision whether to sell a product

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents