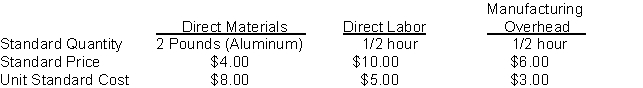

National Sporting Goods Company manufactures aluminum baseball bats that it sells to university athletic departments. It has developed the following per unit standard costs for 2011 for each baseball bat:

In 2011, the company planned to produce 80,000 baseball bats at a level of 40,000 hours of direct labor.

Actual results for 2011 are presented below:

1. Direct materials purchases were 164,000 pounds of aluminum which cost $688,800.

2. Direct materials used were 145,000 pounds of aluminum.

3. Direct labor costs were $379,270 for 39,100 direct labor hours actually worked.

4. Total manufacturing overhead was $235,000.

5. Actual production was 76,000 baseball bats.

Instructions

(a) Compute the following variances:

1. Direct materials price.

2. Direct materials quantity.

3. Direct labor price.

4. Direct labor quantity.

5. Total overhead variance.

(b) Prepare the journal entries to record the transactions and events in 2011.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q188: Markowitz Corporation prepared the following variance report.

Q189: Presented below is a flexible manufacturing budget

Q191: George Company has a standard costing system.

Q192: Hurley, Inc. manufactures widgets for distribution. The

Q194: Jamison Industries provided the following information about

Q196: Humphreys, Inc. uses standard costing for its

Q197: The following direct labor data pertain to

Q198: Wagner Company developed the following standard

Q236: In developing a standard cost for direct

Q239: The difference between actual hours times the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents