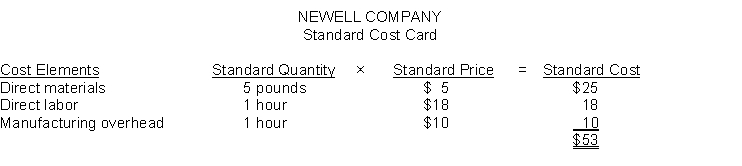

Newell Company developed the following standards for 2011:

The company planned to produce 90,000 units of product and work at the 90,000 direct labor level of activity in 2011. The company uses a standard cost accounting system which records standard costs in the accounts and recognizes variances in the accounts at the earliest opportunity. During 2011, 87,000 actual units of product were produced.

Instructions

Prepare the journal entries to record the following transactions for Newell Company during 2011.

(a) Purchased 441,000 pounds of raw materials for $4.90 per pound on account.

(b) Actual direct labor payroll amounted to $1,581,000 for 85,500 actual direct labor hours worked. Factory labor cost is to be recorded and distributed to production.

(c) Direct materials issued for production amounted to 441,000 pounds which actually cost $4.90 per pound.

(d) Actual manufacturing overhead costs incurred were $864,000 in 2011.

(e) Manufacturing overhead was applied when the 87,000 units were completed.

(f) Transferred the 87,000 completed units to finished goods.

Correct Answer:

Verified

Q177: Ratliff Industries provided the following information about

Q178: During March, Odle Company purchases and uses

Q179: Cinelli Company purchased 6,000 units of raw

Q180: Vega Company has developed the following

Q183: Landis Company planned to produce 20,000 units

Q184: The following information was taken from the

Q185: Dains Company planned to produce 20,000 units

Q186: Gamblian Company's standard labor cost of producing

Q187: Lake Company uses a standard cost accounting

Q230: Standards which represent optimum performance under perfect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents