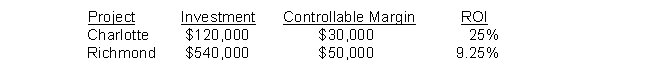

The area manager of the Little Italy Restaurants is considering two possible expansion alternatives. The required investments, expected controllable margins, and the ROIs of each are as follows:  The Little Italy segment has currently $2,000,000 in invested capital and a controllable margin of $250,000. Which one of following projects will increase the Little Italy division's ROI?

The Little Italy segment has currently $2,000,000 in invested capital and a controllable margin of $250,000. Which one of following projects will increase the Little Italy division's ROI?

A) Both the Charlotte and Richmond options

B) Only the Charlotte option

C) Only the Richmond option

D) Neither the Charlotte nor the Richmond options

Correct Answer:

Verified

Q129: Edmunds Division's operating results include: controllable margin

Q130: An investment center generated a contribution margin

Q131: Janes Corporation recorded operating data for its

Q133: DeLong Corporation recorded operating data for its

Q135: Olathe Division of Hartley Company's operating results

Q136: The current controllable margin for Frederick Division

Q137: Miles Company had average operating assets of

Q138: A distinguishing characteristic of an investment center

Q138: The Western Division of Guinn Corp. had

Q139: Neill Manufacturing reported the following items for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents