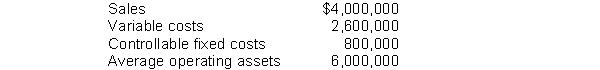

The West Division of Pierce Company reported the following data for the current year.

Top management is unhappy with the investment center's return on investment (ROI). It asks the manager of the West Division to submit plans to improve ROI in the next year. The manager believes it is feasible to consider the following independent courses of action.

1. Increase sales by $420,000 with no change in the contribution margin percentage.

2. Reduce variable costs by $120,000.

3. Reduce average operating assets by 4%

Instructions

(a) Compute the return on investment (ROI) for the current year.

(b) Using the ROI formula, compute the ROI under each of the proposed courses of action. (Round to one decimal.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q184: Data for the following subsidiaries of Roberts

Q185: Ramirez Manufacturing Inc. has three divisions which

Q186: Payne Company has two investment centers and

Q187: Data concerning manufacturing overhead for Barkley Company

Q189: Lock Clothing Company's static budget at 2,000

Q191: SEK Rental Company reported the following:

Q193: In analyzing differences from planned objectives management

Q193: The East Division, a profit center of

Q194: The use of budgets in controlling operations

Q196: The master budget is a _ budget

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents