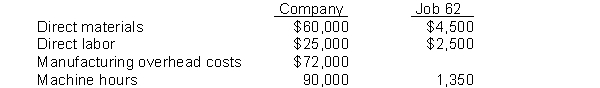

Graham Manufacturing is a small manufacturer that uses machine-hours as its activity base for assigned overhead costs to jobs. The company estimated the following amounts for 2010 for the company and for Job 62:

During 2010, the actual machine-hours totaled 94,000, and actual overhead costs were $71,000.

Instructions

(a) Compute the predetermined overhead rate.

(b) Compute the total manufacturing costs for Job 62.

(c) How much overhead is over or underapplied for the year for the company? State amount and whether it is over- or underapplied.

(d) If Graham Manufacturing sells Job 62 for $14,000, compute the gross profit.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q167: A job cost sheet of Fugate Company

Q168: Watson Manufacturing Company employs a job order

Q169: Job cost sheets for Howard Manufacturing are

Q170: Builder Bug Company allocates manufacturing overhead at

Q171: Selected accounts of Kosar Manufacturing Company at

Q173: Garner Company begins operations on July 1,

Q174: The following inventory information is available for

Q175: Fort Corporation had the following transactions during

Q176: Manufacturing cost data for Dolan Company, which

Q177: At May 31, 2010, the accounts of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents