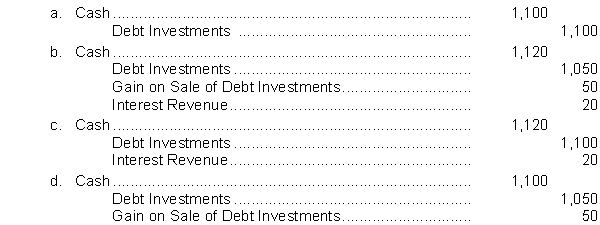

On January 1, Barone Company purchased as a short-term investment a $1,000, 8% bond for $1,050. The bond pays interest on January 1 and July 1. The bond is sold on October 1 for $1,100 plus accrued interest. Interest has not been accrued since the last interest payment date. What is the entry to record the cash proceeds at the time the bond is sold?

Correct Answer:

Verified

Q45: If a short-term debt investment is sold,

Q47: Barr Company acquires 60, 10%, 5 year,

Q48: Winrow Co. purchased 50, 6% Johnston Company

Q49: Winrow Co. purchased 50, 6% Johnston Company

Q50: Barr Company acquires 60, 10%, 5 year,

Q51: Nagen Company had these transactions pertaining to

Q53: Which of the following is not a

Q54: Nagen Company had these transactions pertaining to

Q55: On January 1, 2010, Milton Company purchased

Q56: Tolan Co. purchased 60, 6% Irick Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents