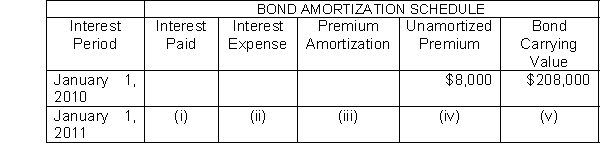

Presented here is a partial amortization schedule for Courtney Company who sold $200,000, five year 10% bonds on January 1, 2010 for $208,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (ii) ?

Which of the following amounts should be shown in cell (ii) ?

A) $21,600

B) $18,400

C) $20,800

D) $19,200

Correct Answer:

Verified

Q117: Each of the following may be shown

Q119: If the present value of lease payments

Q120: The discount on bonds payable or premium

Q121: Presented here is a partial amortization schedule

Q122: If bonds are originally sold at a

Q124: Silcon Company issued $500,000 of 6%, 10-year

Q125: On January 1, Cleopatra Corporation issued $3,000,000,

Q126: When the effective-interest method of bond discount

Q127: On January 1, Grogan Corporation issues $1,000,000,

Q128: When the effective-interest method of bond premium

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents