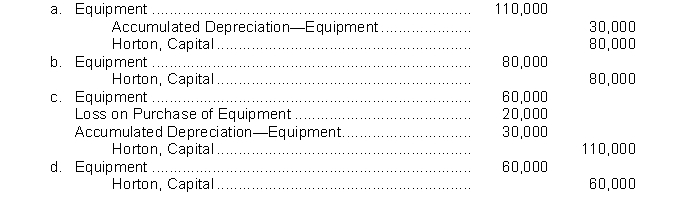

Horton invests personally owned equipment, which originally cost $110,000 and has accumulated depreciation of $30,000 in the Horton and Matile partnership. Both partners agree that the fair market value of the equipment was $60,000. The entry made by the partnership to record Horton's investment should be

Correct Answer:

Verified

Q46: Limited partnerships

A) must have at least one

Q48: The individual assets invested by a partner

Q50: Which one of the following would not

Q51: Which of the following statements about a

Q53: A partnership

A) is dissolved only by the

Q60: The largest companies in the United States

Q61: The most appropriate basis for dividing partnership

Q61: A partner's share of net income is

Q62: Sam is investing in a partnership with

Q63: L. Trevino and B. Hogan combine their

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents