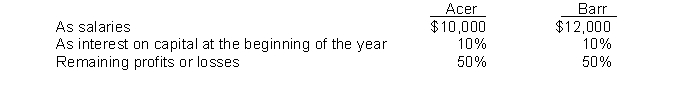

Partners Acer and Barr have capital balances in a partnership of $40,000 and $60,000, respectively. They agree to share profits and losses as follows:  If income for the year was $50,000, what will be the distribution of income to Barr?

If income for the year was $50,000, what will be the distribution of income to Barr?

A) $23,000

B) $27,000

C) $20,000

D) $10,000

Correct Answer:

Verified

Q72: Which one of the following would not

Q74: The partnership agreement of Nieto, Keller, and

Q75: Danny and Vicky are forming a partnership.

Q76: Partners Don and Ron have agreed to

Q77: Danny and Vicky are forming a partnership.

Q80: Rosen and Noble decide to organize a

Q81: The owners' equity statement for a partnership

Q82: The net income of the Rice and

Q84: The total column of the Partners' Capital

Q85: The liquidation of a partnership may result

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents