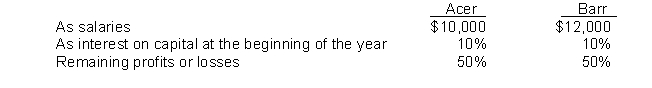

Partners Acer and Barr have capital balances in a partnership of $40,000 and $60,000, respectively. They agree to share profits and losses as follows:  If net loss for the year was $2,000, what will be the distribution to Barr?

If net loss for the year was $2,000, what will be the distribution to Barr?

A) $12,000 income

B) $1,000 income

C) $1,000 loss

D) $2,000 loss

Correct Answer:

Verified

Q61: A partner's share of net income is

Q61: The most appropriate basis for dividing partnership

Q62: Sam is investing in a partnership with

Q63: L. Trevino and B. Hogan combine their

Q65: The partnership agreement of Nieto, Keller, and

Q67: Partners Acer and Barr have capital balances

Q68: A partner invests into a partnership a

Q69: Danny and Vicky are forming a partnership.

Q70: Partners Bob and Don have agreed to

Q71: The Raney and Kiser partnership agreement stipulates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents