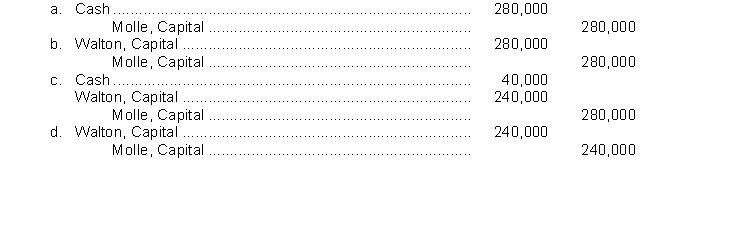

Roper and Walton have partnership capital balances of $320,000 and $240,000, respectively. Walton negotiates to sell his partnership interest to Molle for $280,000. Roper agrees to accept Molle as a new partner. The partnership entry to record this transaction is

Correct Answer:

Verified

Q122: Which of the following is correct when

Q124: D. Dieker purchases a 25% interest for

Q126: Eberle and Lankton are partners who share

Q126: When a partnership interest is purchased

A) every

Q127: A bonus to a new partner will

A)

Q128: Finney is admitted to a partnership with

Q132: When admitting a new partner by investment

Q132: Diaz and Helms sell to Mayo a

Q133: A bonus to a new partner

A) is

Q136: When admitting a new partner by investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents