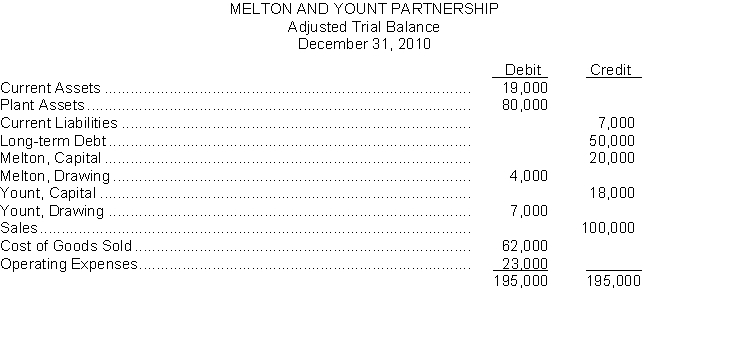

The adjusted trial balance of the Melton and Yount Partnership for the year ended December 31, 2010, appears below:

The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows:

1. A salary allowance of $12,000 to Melton and $23,000 to Yount.

2. The remainder is to be divided equally.

Instructions

(a) Prepare a schedule which shows the division of net income to each partner.

(b) Prepare the closing entries for the division of net income and for the drawing accounts at December 31, 2010.

Correct Answer:

Verified

Q169: Fink & Elston Co. reports net income

Q170: Pinella (beginning capital, $80,000) and H. Johnston

Q171: Ace, Goran, and Notte are forming The

Q172: Flaherty, P. Denny, and G. Newman are

Q173: Santo Company and Renfro Company decide to

Q175: The Frick & Frack Co. reports net

Q176: Ron and Linda are partners who share

Q177: Capital balances in Carson Co. are Donald

Q178: Joe Mann and Sam Trane operate separate

Q179: After liquidating noncash assets and paying creditors,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents