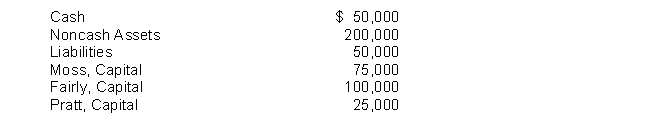

The MFP Partnership is to be liquidated when the ledger shows the following:

Moss, Fairly, and Pratt's income ratios are 6:3:1, respectively.

Instructions

Prepare separate entries to record the liquidation of the partnership assuming that the noncash assets are sold for $150,000 in cash.

Correct Answer:

Verified

Q182: A partnership characteristic which enables each partner

Q188: The capital accounts indicate each partner's _

Q192: Hoy, Lever, and Stone share income on

Q194: The Mago Company at December 31 has

Q195: Donna Leeds and Ann Reeves have capital

Q197: Eaton, Korman, and Roland have capital balances

Q198: Jim Welch and Sam Thayer share partnership

Q199: Dobson, Lancaster, and Pender are partners who

Q200: Bale, Heller, and Winrow share income and

Q203: A _ allowance or _ on partners'

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents