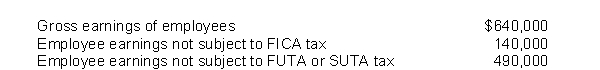

Hiatt Company had the following payroll data for the year:

Assuming the following:

Instructions

Compute Hiatt's payroll tax expense for the year. Make a summary journal entry to record the payroll tax expense.

Correct Answer:

Verified

Q186: Pam Norman had earned (accumulated) salary of

Q187: The following payroll liability accounts are included

Q190: Haney Company's payroll for the week ending

Q192: Foster Company is preparing adjusting entries at

Q193: Eve Trek's regular hourly wage is $14

Q194: Cindy Morrow's regular hourly wage rate is

Q195: Delaney Company sells a product that includes

Q196: Marx Company sells exercise machines for home

Q204: A current liability is a debt that

Q209: Sales taxes collected from customers are a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents