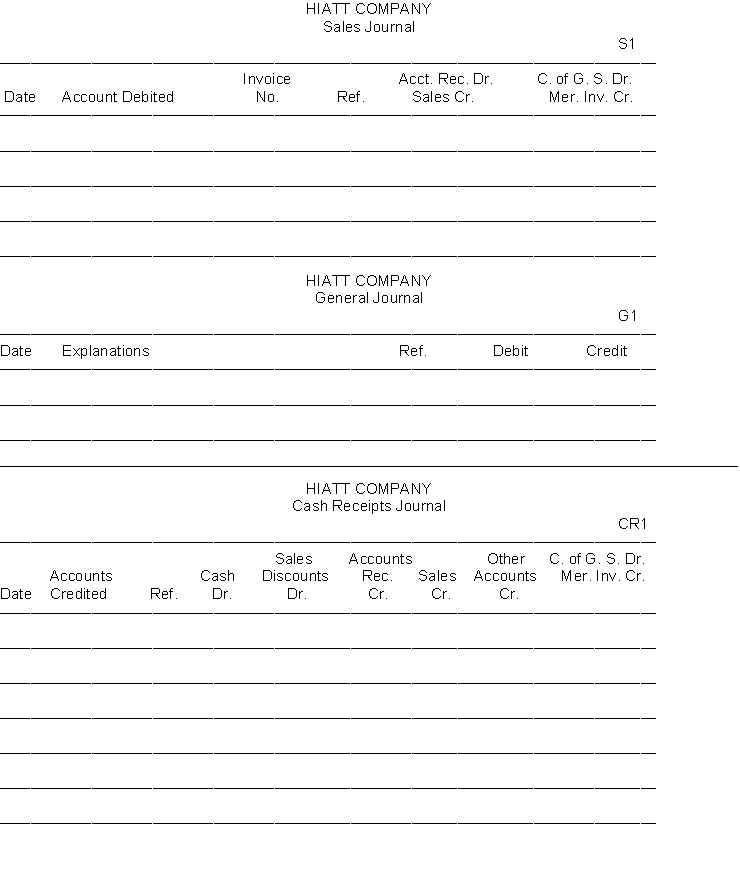

Hiatt Company uses a sales journal, a cash receipts journal, and a general journal to record transactions with its customers. Record the following transactions in the appropriate journals. The cost of all merchandise sold was 70% of the sales price.

July 2 Sold merchandise for $15,000 to B. Pine on account. Credit terms 2/10, n/30. Sales invoice No. 100.

July 5 Received a check for $800 from R. Giger in payment of his account.

July 8 Sold merchandise to F. Wenger for $900 cash.

July 10 Received a check in payment of Sales invoice No. 100 from B. Pine minus the 2% discount.

July 15 Sold merchandise for $9,000 to J. Long on account. Credit terms 2/10, n/30. Sales invoice No. 101.

July 18 Borrowed $25,000 cash from United Bank signing a 6-month, 10% note.

July 20 Sold merchandise for $12,000 to C. Judd on account. Credit terms 2/10, n/30. Sales invoice No. 102.

July 25 Issued a credit (reduction) of $600 to C. Judd as an allowance for damaged merchandise previously sold on account.

July 31 Received a check from J. Long for $5,000 as payment on account.

Correct Answer:

Verified

Q108: If a customer takes a sales discount

Q111: Mangino Company has a balance in its

Q112: Evans Company uses a single-column purchases journal,

Q112: Companies record credit purchases of equipment or

Q113: When the totals of the sales journal

Q114: Richey Company maintains four special journals and

Q116: On December 1, the accounts receivable control

Q117: After Shaw Company had completed all posting

Q117: Credit sales of assets other than merchandise

Q120: Handy Company uses both special journals and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents