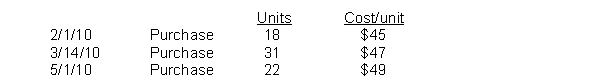

Lee Industries had the following inventory transactions occur during 2010:  The company sold 51 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

The company sold 51 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

A) $772

B) $848

C) $594

D) $540

Correct Answer:

Verified

Q84: Lee Industries had the following inventory transactions

Q85: Holliday Company's inventory records show the following

Q86: Shandy Shutters has the following inventory information.

Q87: Neighborly Industries has the following inventory information.

Q88: Holliday Company's inventory records show the following

Q90: Shandy Shutters has the following inventory information.

Q91: Companies adopt different cost flow methods for

Q92: Lee Industries had the following inventory transactions

Q93: Unitech has the following inventory information.

Q94: Shandy Shutters has the following inventory information.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents