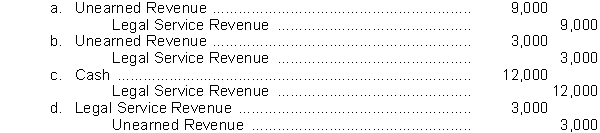

Mike Conway is a lawyer who requires that his clients pay him in advance of legal services rendered. Mike routinely credits Legal Service Revenue when his clients pay him in advance. In June Mike collected $12,000 in advance fees and completed 75% of the work related to these fees. What adjusting entry is required by Mike's firm at the end of June?

Correct Answer:

Verified

Q50: An adjusted trial balance

A)is prepared after the

Q139: If unearned revenues are initially recorded in

Q141: The revenue recognition principle dictates that revenue

Q144: Myron is a barber who does his

Q147: Sail & Surf Cruises purchased a five-year

Q150: Which of the following statements concerning accrual-basis

Q159: Which of the statements below is not

Q188: Financial statements are prepared directly from the

A)

Q189: State whether each situation is a prepaid

Q196: If the adjusting entry for depreciation is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents