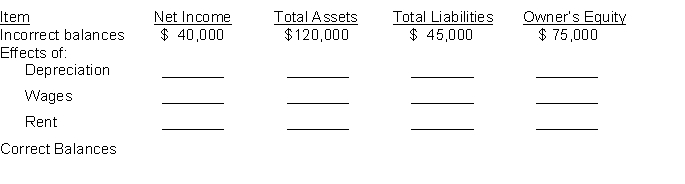

On December 31, 2010, Speedy Company prepared an income statement and balance sheet and failed to take into account three adjusting entries. The incorrect income statement showed net income of $40,000. The balance sheet showed total assets, $120,000; total liabilities, $45,000; and owner's equity, $75,000.

The data for the three adjusting entries were:

(1) Depreciation of $9,000 was not recorded on equipment.

(2) Wages amounting to $8,000 for the last two days in December were not paid and not recorded. The next payroll will be in January.

(3) Rent of $14,000 was paid for two months in advance on December 1. The entire amount was debited to Rent Expense when paid.

Instructions

Complete the following tabulation to correct the financial statement amounts shown (indicate deductions with parentheses):

Correct Answer:

Verified

Q167: Rhodes National purchased software on October 1,

Q168: On January 1, Bit & Bridle, CPAs

Q169: Prepare adjusting entries for the following transactions.

Q170: On February 1, Results Income Tax Service

Q174: Ramona's Music School borrowed $20,000 from the

Q175: Determine the impact on the balance sheet

Q176: Jeff Anderer Enterprises purchased computer equipment on

Q177: Before month-end adjustments are made, the

Q213: Indicate (a) the type of adjustment (prepaid

Q220: Identify the impact on the balance sheet

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents