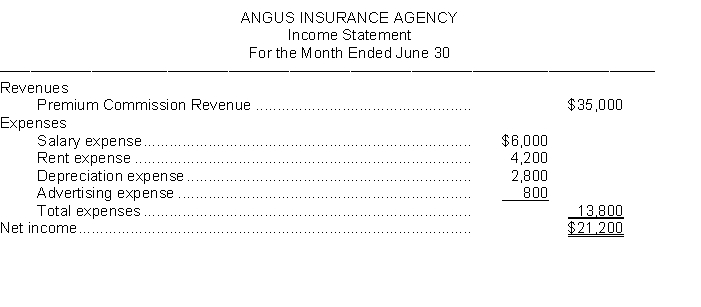

Angus Insurance Agency prepares monthly financial statements. Presented below is an income statement for the month of June that is correct on the basis of information considered.

Additional Data: When the income statement was prepared, the company accountant neglected to take into consideration the following information:

1. A utility bill for $2,000 was received on the last day of the month for electric and gas service for the month of June.

2. A company insurance salesman sold a life insurance policy to a client for a premium of $35,000. The agency billed the client for the policy and is entitled to a commission of 20%.

3. Supplies on hand at the beginning of the month were $3,000. The agency purchased additional supplies during the month for $3,500 in cash and $2,200 of supplies were on hand at June 30.

4. The agency purchased a new car at the beginning of the month for $19,200 cash. The car will depreciate $4,800 per year.

5. Salaries owed to employees at the end of the month total $5,300. The salaries will be paid on July 5.

Instructions

Prepare a correct income statement.

Correct Answer:

Verified

Q191: On July 1, 2010, Jeffrey Underwriters Associates

Q192: The adjusted trial balance of the Neighborly

Q193: Match the statements below with the appropriate

Q194: Wham Company accumulates the following adjustment data

Q195: Scotsman Company prepares monthly financial statements. Below

Q197: Compute the net income for 2010 based

Q198: One part of eight adjusting entries is

Q199: Presented below is the Trial Balance and

Q200: Prepare the necessary adjusting entry for each

Q201: The matching principle attempts to match _

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents