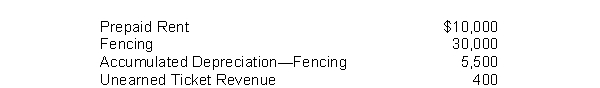

The Poway Animal Encounters operates a drive through tourist attraction. The company adjusts its accounts at the end of each month. The selected accounts appearing below reflect balances after adjusting entries were prepared on April 30. The adjusted trial balance shows the following:

Other data:

1. Three months' rent had been prepaid on April 1.

2. The fencing is being depreciated at $6,000 per year.

3. The unearned ticket revenue represents tickets sold for future visits. The tickets were sold at $4.00 each on April 1. During April, twenty of the tickets were used by customers.

Instructions

(a) Calculate the following:

1. Monthly rent expense.

2. The age of the fencing in months.

3. The number of tickets sold on April 1.

(b) Prepare the adjusting entries that were made by the Poway Animal Encounters on April 30.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q185: Ben Cartwright Pest Control has the following

Q186: The following ledger accounts are used by

Q187: Prepare the required end-of-period adjusting entries for

Q188: On July 1, 2010, Patrick Company pays

Q189: Trench and Fog Garment Company purchased equipment

Q191: On July 1, 2010, Jeffrey Underwriters Associates

Q192: The adjusted trial balance of the Neighborly

Q193: Match the statements below with the appropriate

Q194: Wham Company accumulates the following adjustment data

Q195: Scotsman Company prepares monthly financial statements. Below

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents