Westwood Gear, Inc., recently received a special order to manufacture 10,000 units for a Canadian company. This order specified that the selling price per unit should not exceed $50. Since the order was received without the effort of the sales department, no commission would be paid. However, an export handling charge of $5 per unit would be incurred. Management anticipates that acceptance of the order will have no effect on other sales.

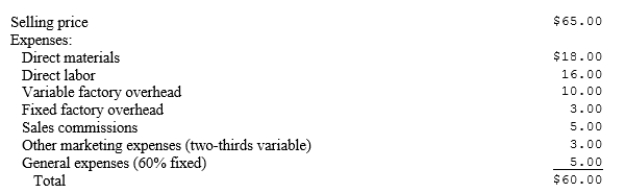

The company is now operating at 80 percent of capacity, or 80,000 units, and expects to continue at this level for the coming year without the Canadian order. Unit costs based on estimated actual capacity for the coming year include:  Prepare an analysis showing the effect on profits if the special order is accepted by the company. Based on your analysis, should the order be filled, and why?

Prepare an analysis showing the effect on profits if the special order is accepted by the company. Based on your analysis, should the order be filled, and why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q58: The Blue Saints Band is holding a

Q60: A traditional break-even chart is illustrated below:

Q61: Sherpa Manufacturing has the following income statement

Q62: Hoctor Industries wishes to determine the profitability

Q65: Tress Enterprises manufactures shampoo and conditioner. Last

Q66: Busby Company needs 10,000 units of a

Q72: The Gaylord Company has sales of $800,000,variable

Q74: In performing an activity-based costing study for

Q77: The practice of accepting a selling price

Q78: An example of a distribution cost that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents