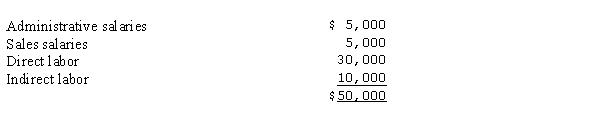

Harmony Company has accrued payroll costs of $50,000 for the period May 28 - 31 as follows:  Other Information: (a) The FICA rate is 8% of the first $100,000 of wages. None of the employees has reached this maximum.

Other Information: (a) The FICA rate is 8% of the first $100,000 of wages. None of the employees has reached this maximum.

(b) The company is responsible for state and federal unemployment taxes on the first $8,000 of wages. All of the employees have previously reached this maximum.

(c) Payroll taxes are spread over all jobs.

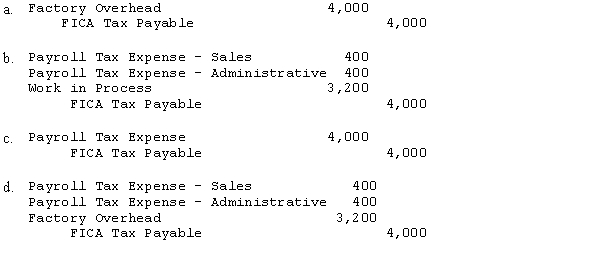

What entry would be necessary to accrue payroll taxes for the period of May 28 - 31?

Correct Answer:

Verified

Payroll tax expense - sales

5,000 x 8%...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Jay Vato works at Batwing Industries from

Q22: An accrued expense such as Wages Payable

Q27: Features of a 401(k)plan include all of

Q32: Joel Williams works at Allentown Company where

Q33: Daktari Enterprises' Schedule of Earnings and Payroll

Q34: Toshlin issues financial statements June 30th. If

Q36: The entry made in November to reverse

Q38: The Dehl Company payroll for the first

Q39: John Elton, who is classified as direct

Q43: A factory worker earns $500 per week

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents