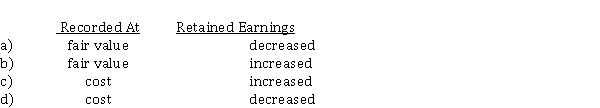

Emily Corp. owned shares in Carr Ltd. On December 1, 2020, Emily declared and distributed a property dividend of Carr shares when their fair value exceeded the carrying amount. As a consequence of the dividend declaration and distribution, the accounting effects would be Property Dividends

Correct Answer:

Verified

Q49: How would total shareholders' equity be affected

Q50: An investment in marketable securities was distributed

Q51: Aye Corp. was organized in January 2020

Q52: Use the following information to answer questions

Q53: On December 1, 2020, Dee Ltd. agreed

Q55: Elves Ltd. owns 150,000 shares of Rogue

Q56: How would the declaration of a 15%

Q57: The dollar amount of a cash dividend

Q58: Which of the following is NOT a

Q59: Frieds Corp. was organized on January 1,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents