Dividend distribution

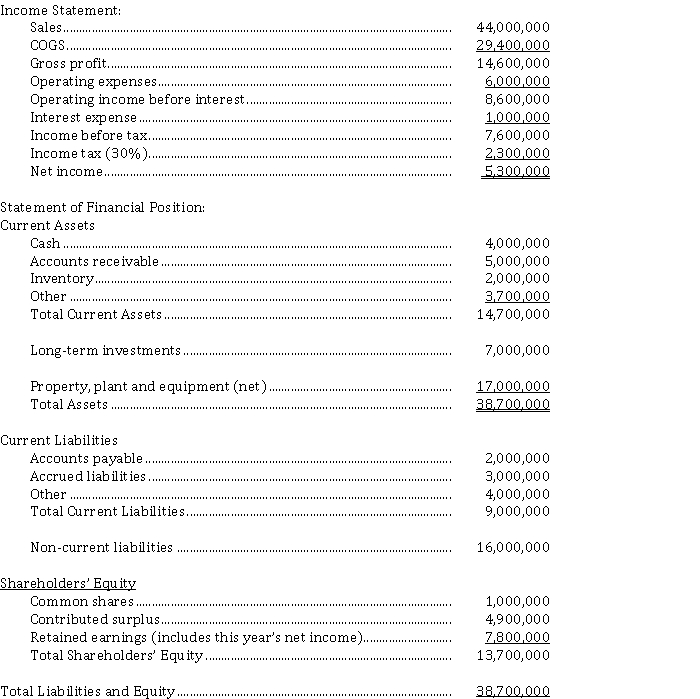

You have recently been appointed CEO of Dumbledore Ltd., a wholesale distributor of magic supplies. One day your CFO reminds you that next week you will have to make recommendations to the board of directors regarding this year's annual dividend. This catches you totally by surprise. Luckily, the CFO was kind enough to provide you with some additional information. He shows you the projected income statement and balance sheet, without the effect of any dividend declaration.  Other information:

Other information:

1) Last year, the net income was $ 3,500,000, and $ 3,300,000 cash dividends were paid.

2) Dumbledore has two debt agreements that call for the corporation to maintain at least $ 2,500,000 in retained earnings, as well as maintain a debt-to-total-assets ratio of no more than 70%.

3) There has been no change in the number of shares outstanding during the year.

You start to think about the recommendations you are going to make. It is the end of November, and historically the corporation has declared dividends five days before the end of the year.

Instructions

a) What factors will limit the amount to be distributed as dividends?

b) What are important considerations in your decision? What would you recommend? Provide any journal entry that is related to your decision.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q148: *Treasury shares

At December 31, 2019, Ukraine Ltd.'s

Q149: Shareholders' Equity Section

Mackenzie Corporation's post-closing trial balance

Q150: Share retirement and stock dividends

Sudan Enterprises Inc.

Q151: Lump sum issuance of par value shares

Chile

Q152: *Calculation of selected financial ratios

Cuba Corp. provides

Q154: *Financial reorganization

The following shareholders' equity accounts were

Q155: Allocation of cash dividends

Togo Inc. has

Q156: *Treasury shares

Zambia Ltd. currently has 150,000 no

Q157: Statement of Shareholders' Equity

Following is information provided

Q158: Capital disclosures

Numerous disclosures are required under ASPE

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents