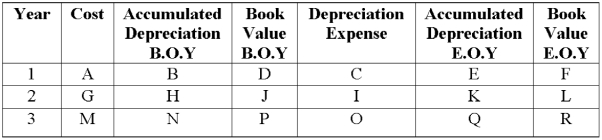

Using the declining-balance method, complete the table as shown (twice the straight-line rate):

Auto: $26,000

Estimated life: 10 years

Residual value: $600

Correct Answer:

Verified

Q29: Straight-line depreciation does not:

A)Use residual to calculate

Q34: If a car is depreciated in four

Q36: MACRS does not use residual value; thus,

Q38: Depreciation expense is located on the:

A) Income

Q38: In the declining-balance method, we can depreciate

Q41: A new truck costing $60,000 with a

Q44: Using the declining-balance method, complete the table

Q49: A truck costs $35,000 with a residual

Q49: A truck costs $9,200 with a residual

Q52: A truck costs $8,000 with a residual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents